games-tv.site

Tools

Envio De Dinero A Venezuela

Ten el control de tu vida financiera Globalmente. Paga en todo el mundo, convierte a dólares y otras divisas y envía dinero a +70 países. Do you need to send money to Venezuela at the best exchange rate? Download our application for Android OS and do it from anywhere; Easy, fast and safe. Envía y Recibe dinero en Venezuela de forma segura, confiable y conveniente con Casa de Cambio ZOOM, Agente Autorizado Western Union desde Venezuela, surge la iniciativa de crear REMESAS Brindamos el Empieza a enviar dinero a tus familiares o amigos de la manera más efectiva posible. Envía dinero a Colombia desde games-tv.site · Haz clic en “Enviar dinero” en el menú de navegación · Selecciona los métodos de pago y recepción del dinero. Somos la App de envío de dinero que más BENEFICIOS TE DA. ¡Descárgala ya! Introduce el monto a enviar, selecciona un método de entrega, crea un beneficiario y envía el dinero utilizando los métodos de pago disponibles en el país en. Y recuerda que con la App Retorna, puedes enviar dinero a tus seres queridos en Venezuela y Colombia rápido, fácil y seguro. ¡Envía ahora! games-tv.site Utiliza la calculadora para definir el monto exacto que deseas enviar. El valor de las distintas monedas se expresa a partir de las tasas de cambio de hoy. Ten el control de tu vida financiera Globalmente. Paga en todo el mundo, convierte a dólares y otras divisas y envía dinero a +70 países. Do you need to send money to Venezuela at the best exchange rate? Download our application for Android OS and do it from anywhere; Easy, fast and safe. Envía y Recibe dinero en Venezuela de forma segura, confiable y conveniente con Casa de Cambio ZOOM, Agente Autorizado Western Union desde Venezuela, surge la iniciativa de crear REMESAS Brindamos el Empieza a enviar dinero a tus familiares o amigos de la manera más efectiva posible. Envía dinero a Colombia desde games-tv.site · Haz clic en “Enviar dinero” en el menú de navegación · Selecciona los métodos de pago y recepción del dinero. Somos la App de envío de dinero que más BENEFICIOS TE DA. ¡Descárgala ya! Introduce el monto a enviar, selecciona un método de entrega, crea un beneficiario y envía el dinero utilizando los métodos de pago disponibles en el país en. Y recuerda que con la App Retorna, puedes enviar dinero a tus seres queridos en Venezuela y Colombia rápido, fácil y seguro. ¡Envía ahora! games-tv.site Utiliza la calculadora para definir el monto exacto que deseas enviar. El valor de las distintas monedas se expresa a partir de las tasas de cambio de hoy.

Incluya una nota opcional y toque “Enviar dinero”. Reciba dinero. Inscriba su número de teléfono móvil o dirección de correo electrónico de EE. UU. y el. Barri cuenta con miles de puntos de pago para envios de dinero a México, El Salvador, Honduras, Guatemala y muchos más. Cambiamos sus Cheques al mejor. Transferencia de dinero de persona a persona. Conocer más. Envía directo a cuenta bancaria desde RD. ¡Tu solución más. Transferencia Bancaria. Envía dinero de forma segura y directa a una cuenta bancaria. ; Pago Móvil. Envía dinero al instante a billeteras electrónicas y pago. Envía dinero al extranjero de forma más rápida, fácil y segura con Retorna App. Disfruta de transferencias internacionales confiables y eficientes. Envía efectivo para pago en ventanilla o entrega. O bien, envía dinero directamente para depósito bancario o a tarjetas de débito u otras billeteras móviles. Envios de carga aérea y marítima a Colombia Venezuela y Europa % Envíos desde Canadá a Venezuela, Colombia, México y Europa. Servicio de Mudanzas. Debido a cierres temporales y horarios reducidos, verifica el estado de las localidades de Agente antes de enviar o cobrar dinero. Las opciones de envío y. Envía y recibe dinero en cualquier parte del mundo a través de RIA, VIGO y DOLEX. Ver más +. Ofrecemos 88, ubicaciones en los Estados Unidos para depositar tu efectivo incluyendo tiendas como Walgreens, Dollar General, Walmart, ¡y más! Envía dinero a. Nuestros clientes pueden enviarle dinero a sus familiares directamente a bancos, tiendas de conveniencia u otros Agentes pagadores cercanos a sus hogares y con. Puedes enviar dinero con una tarjeta de crédito o débito, o desde una cuenta bancaria. Algunas formas de pago son más asequibles mientras que otras son más. Remexas, somos la nueva plataforma confiable para transferir dinero a Venezuela en tan solo cuestión de minutos. Con oficinas en Canadá y Venezuela garantizamos. Puedes enviar dinero a cuentas bancarias en el exterior % online, ya no perderás dinero ni tiempo yendo a una oficina. Compra y venta de dólares digitales. We offer our clients logistic solutions for handling, transporting and shipping packages within the United States and to Colombia, Venezuela, Ecuador, the. Con Félix puedes enviar dinero a México, Guatemala y Honduras con tan sólo un mensaje de WhatsApp. ¡Olvídate de las filas y de descargar aplicaciones! Con más de 41 años de experiencia, somos la empresa líder en cambio de dólares online y envío de dinero desde Perú. Kajita y Kajota para envío marítimo. Con nuestro servicio de carga marítima a Venezuela puedes enviar a todo el país y recibir en mínimo 25 días. ¿No tienes. La mayor cobertura en Envios a Venezuela, desde Miami o desde cualquier parte del mundo llevamos tus envios a Venezuela. Llegamos a mas de destinos. Una nueva experiencia en envíos de dinero internacional. Únete a más de personas que ya tienen su billetera digital. ¡Registrate ahora!

Paul Rotter Trader

Insights from Paul Rotter 'The Flipper': Famous Day Trader and Scalper. UKspreadbetting · 8 Trading Tips from Some of the World's Best. with examples of traders who utilize that style (Warren Buffet, Paul Tudor Jones, George Soros, Paul Rotter, etc.). Such examples are good for their. Paul Rotter stands as a legendary figure in the realm of scalp traders, particularly within the German government bond market. Paul Rotter (The Flipper) is a trader that has reportedly made $ million per year for 10 years, scalping the most liquid contracts at the biggest futures. Also saw a reference there to Paul Rotter - the worlds most successful scalper.. an analyst or some kind of guru has to stick to it, but as a trader you. Paul Rotter, also known as “The Flipper,” became famous for his scalping This strategy induced other traders to respond, allowing Rotter to take advantage of. If you set your heart on scalping trading, you might be interested in getting professional advice from the most successful scalper of all times – Paul Rotter. #1 Paul Rotter: The Eurex Flipper. Meet Paul Rotter, a trader so quick they nicknamed him “The Eurex Flipper.” He's like the Usain Bolt of. Justin Pugsley interviewed the legendary trader, Paul Rotter: PR: “The worst day I had was in when Socgen (the French bank) was. Insights from Paul Rotter 'The Flipper': Famous Day Trader and Scalper. UKspreadbetting · 8 Trading Tips from Some of the World's Best. with examples of traders who utilize that style (Warren Buffet, Paul Tudor Jones, George Soros, Paul Rotter, etc.). Such examples are good for their. Paul Rotter stands as a legendary figure in the realm of scalp traders, particularly within the German government bond market. Paul Rotter (The Flipper) is a trader that has reportedly made $ million per year for 10 years, scalping the most liquid contracts at the biggest futures. Also saw a reference there to Paul Rotter - the worlds most successful scalper.. an analyst or some kind of guru has to stick to it, but as a trader you. Paul Rotter, also known as “The Flipper,” became famous for his scalping This strategy induced other traders to respond, allowing Rotter to take advantage of. If you set your heart on scalping trading, you might be interested in getting professional advice from the most successful scalper of all times – Paul Rotter. #1 Paul Rotter: The Eurex Flipper. Meet Paul Rotter, a trader so quick they nicknamed him “The Eurex Flipper.” He's like the Usain Bolt of. Justin Pugsley interviewed the legendary trader, Paul Rotter: PR: “The worst day I had was in when Socgen (the French bank) was.

Paul Rotter, the legendary scalper, on the benefit of Risk Management Tools: What separates moderately successful traders from very successful traders? I. Paul Rotter is one of the largest and most successful futures traders in the world, executing up to trades daily in German Bund futures on the Eurex. The numbers of contracts, the numbers of ticks gained may vary but this is a game that is played on a regular basis. If you've ever heard of Paul Rotter, AKA. A trader should have no opinion. The stronger your opinion, the harder it is to get out of a losing position. – Paul Rotter –. Formal education will make you. Photo by Earn2Trade ❘ Futures Trading on September 09, May be an image There's still time to join our 8th birthday celebration with an. Scalping is one of the most popular trading strategies. Almost all traders use scalping. Some of them, Paul Rotter, for example, made tens of. “A trader should have no opinion. The stronger your opinion, the harder it is to get out of a losing position.” - Paul Rotter. subscribers in the ForexEXPOSED community. This is a community for serious forex traders who are interested in understanding the actual. Paul Rotter. This trader reportedly made $ million per year over 10 years scalping the most liquid contracts at the Eurex. “I was always the guy who. If you set your heart on scalping trading, you might be interested in getting professional advice from the most successful scalper of all times – Paul Rotter. A trader should have no opinion. The stronger your opinion, the harder it is to get out of a losing position.” -Paul Rotter. Here are two interviews with him. Paul Rotter – Flipping Out · Insight from the Flipper. The Flipper was called the Flipper because he flipped. What is. In , Paul Rotter is considerably the single largest and most successful individual futures trader in the world, completing trades on the Eurex exchange. trader on April 16, "The Man, The Legend, The one and only The Paul Rotter Some consider Paul Rotter one of the best traders in the. Paul U. Ali). The Handbook of Credit Portfolio Management (, with Rotter- dam where he also obtained his Ph.D, and a visiting professor at. "The flipper" is a notorious Eurex own-account trader known in European trading circles. Dozens of prop traders had engaged in a sporting manhunt aimed at. I constantly try to read the psychology of the market and base my decisions on it. Paul Rotter. As a trader you should have no opinion. In the old days, it was a battle between traders, says Paul Rotter, a trader nicknamed The Flipper — unfairly, he says, in reference a trading strategy that. Have you heard about Paul Rotter, nicknamed “The Flipper”? Check out the trading style! games-tv.site #earn2trade. Paul Rotter is one of the most notable scalpers in the world today due to Note that Brooks uses several other strategies when trading, like any other trader.

How To Cancel A Roth Ira Account

If you need to withdraw money from your traditional IRA before you've reached age 59 ½, you'll typically pay a 10% penalty on top of the expected income taxes. Withdrawing funds from your account. Can I withdraw my money? The simple Your Colorado SecureSavings account is a Roth IRA and is designed to help. You can take money out of a Roth IRA retirement savings account but learn when and how to do so to avoid any taxes and penalties. account type for specific withdrawal requirements and considerations from CollegeAmerica and retirement accounts: CollegeAmerica · Traditional and Roth IRAs. account, change the term of the account or cancel the account. For A Roth IRA is a retirement savings account that provides several benefits including. You can also leave the assets in the plan, withdraw the assets as a lump sum distribution, move the assets to the retirement plan of your new employer or. You can withdraw up to the total amount of your direct contributions at any age without tax or penalty. Age of the account doesn't matter either. However, you cannot withdraw the earnings on your contributions before age 59 ½, or before the account has been open for at least five years, without incurring. If you wish to withdraw your earnings from a Roth IRA without paying taxes, you must be 59½ and must have held the Roth IRA for at least five years. Exceptions. If you need to withdraw money from your traditional IRA before you've reached age 59 ½, you'll typically pay a 10% penalty on top of the expected income taxes. Withdrawing funds from your account. Can I withdraw my money? The simple Your Colorado SecureSavings account is a Roth IRA and is designed to help. You can take money out of a Roth IRA retirement savings account but learn when and how to do so to avoid any taxes and penalties. account type for specific withdrawal requirements and considerations from CollegeAmerica and retirement accounts: CollegeAmerica · Traditional and Roth IRAs. account, change the term of the account or cancel the account. For A Roth IRA is a retirement savings account that provides several benefits including. You can also leave the assets in the plan, withdraw the assets as a lump sum distribution, move the assets to the retirement plan of your new employer or. You can withdraw up to the total amount of your direct contributions at any age without tax or penalty. Age of the account doesn't matter either. However, you cannot withdraw the earnings on your contributions before age 59 ½, or before the account has been open for at least five years, without incurring. If you wish to withdraw your earnings from a Roth IRA without paying taxes, you must be 59½ and must have held the Roth IRA for at least five years. Exceptions.

In addition, if you don't withdraw your Roth IRA assets before you pass away, you can leave the account to anyone by designating one or more beneficiaries. *You must meet minimum qualifications to withdraw your Roth funds tax-free. These include a five-year holding period from the year of your first contribution. If you leave your job or retire, you may be able to withdraw funds without penalty — even if you're under retirement age. If, however, you are still employed. account type for specific withdrawal requirements and considerations from CollegeAmerica and retirement accounts: CollegeAmerica · Traditional and Roth IRAs. Guidelines for withdrawals. Withdrawals before age 59½. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. Withdrawing funds from your account. Can I withdraw my money? The simple Your Colorado SecureSavings account is a Roth IRA and is designed to help. ERS will email or mail you the Retirement Account Withdrawal Disclaimer form. Sign the form in the presence of a notary, have it notarized and send it back to. After years or even decades of diligently funding your retirement accounts, you're looking to withdraw all or some of that money. Depending on your age and. Any money you withdraw will be taxed as ordinary income. However, if you contributed money after taxes into an IRA, your withdrawals will not be taxed. Roth. Withdrawals and your account · Can I take out my money? · What if I withdraw money? · Why is saving now so important? · Only 33% of money during retirement comes. Nonqualified withdrawals: If you withdraw conversion contributions before the five-year period is over, you might have to pay a 10% Roth IRA early withdrawal. Login to the Stash app. · Tap on Retirement Portfolio. · Tap the gear icon in the upper-right corner. · Scroll to the bottom, then tap Close retirement account. You can withdraw contributions at any time without tax or penalty. But in most cases, you'll need to wait until you turn 59 ½ and have had the Roth account open. If you are vested and separate from state employment, you can leave your account with ERS or process a withdrawal of your retirement contributions. To withdraw your membership, sign in to your Retirement Online account, go to the 'My Account Summary' area of your Account Homepage and click “Withdraw My. After you reach age 73, the IRS generally requires you to withdraw an RMD annually from your tax-advantaged retirement accounts (excluding Roth IRAs, and Roth. Generally, the steps to terminate a retirement plan include: Amend the plan to: If desired, ask the IRS to make a determination about the plan's qualification. account, change the term of the account or cancel the account. For A Roth IRA is a retirement savings account that provides several benefits including. Roth IRA contributions are taxed but withdrawals are not. · There is no current mandatory distribution age, nor are there restrictions on withdrawing your. The general rules governing a k allow you to make penalty-free withdrawals from retirement accounts only after reaching the age of 59 ½. Beyond that, an IRS.

When To Sell A Call Option

The intent of selling puts is the same as that of selling calls; the goal is for the options to expire worthless. The strategy of selling uncovered puts, more. Writing a covered call means you're selling someone else the right to purchase a stock that you already own, at a specific price, within a specified time frame. WHEN TO CLOSE A LONG CALL OPTION. Buyers of long calls can sell them at any time before expiration for a profit or loss, but ideally the trade is. The key to selling call strategy is to hope that the price of the asset declines and the option becomes worthless before the expiration date. If an investor believes the price of a security is likely to rise, they can buy calls or sell puts to benefit from such a price rise. In buying call options. A strike price is the price that you are allowed to buy (if you purchased a call option contract) or sell (if you have a put) the underlying security at. The. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date. Closing a futures contract: If an investor has “sold to open” a futures contract position and the price of the underlying asset has declined, they can “sell to. When you sell a covered call, you receive premium, but you also give up control of your stock. Keep in mind: Though early exercise could happen at any time, the. The intent of selling puts is the same as that of selling calls; the goal is for the options to expire worthless. The strategy of selling uncovered puts, more. Writing a covered call means you're selling someone else the right to purchase a stock that you already own, at a specific price, within a specified time frame. WHEN TO CLOSE A LONG CALL OPTION. Buyers of long calls can sell them at any time before expiration for a profit or loss, but ideally the trade is. The key to selling call strategy is to hope that the price of the asset declines and the option becomes worthless before the expiration date. If an investor believes the price of a security is likely to rise, they can buy calls or sell puts to benefit from such a price rise. In buying call options. A strike price is the price that you are allowed to buy (if you purchased a call option contract) or sell (if you have a put) the underlying security at. The. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date. Closing a futures contract: If an investor has “sold to open” a futures contract position and the price of the underlying asset has declined, they can “sell to. When you sell a covered call, you receive premium, but you also give up control of your stock. Keep in mind: Though early exercise could happen at any time, the.

Selling calls on stock, we are bullish on gives us a chance to profit even if the stock is stalled out or just chopping sideways. Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes. Early exercise for a call option is when an option holder exercises his purchase right prior to the option's expiration date. Normally an option holder would. The seller (writer) of the call option must sell futures (take the opposite side of the futures transaction) if the buyer exercises the option. For the right to. A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration date. A covered call requires ownership of at least shares of stock. If the stock is already owned, a call option may be sold at a higher strike price than the. When you sell a call option, you are essentially selling the right for someone else to buy shares of a stock from you at a pre-agreed price on a future date. Call option sellers, sometimes referred to as writers, sell call options in the hopes that they will expire worthlessly. They profit by pocketing the premiums. If you sell the call option, then you receive the premium in return for the accepting the risk, that you may need to deliver a futures contract, at a price. Why would you buy or sell a call option? Call options are of interest to investors who believe a certain stock is likely to rise in value, giving them one of. When you sell a call option, the buyer has the right (but not the obligation) to buy shares of your stock at a given price. When they exercise. The difference between a call and put option is that while the former is a right to buy the latter is a right to sell. The option seller is selling a call option because he believes that the price of Bajaj Auto will NOT increase in the near future. When a trader sells to open a call option (a "short call"), it's a bet the stock will stay at or below the strike price through expiration. A sell-to-open transaction is performed when you want to short an options contract, either a call or put option. The trade is also known as writing an option. The person selling you the option—the "writer"—will charge a premium in exchange for this right. When you buy an option, you're the one who will decide if you. A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known. It should not matter whether the option is exercised at expiration. If it is not, the investor is free to sell the stock or redo the covered call strategy. If. As a put seller your maximum loss is the strike price minus the premium. To get to a point where your loss is zero (breakeven) the price of the option should. Selling a put option is a bullish position, as you are betting against the movement of the stock price below your strike price– so, you'd sell a put if you.

Average Home Equity Growth Rate

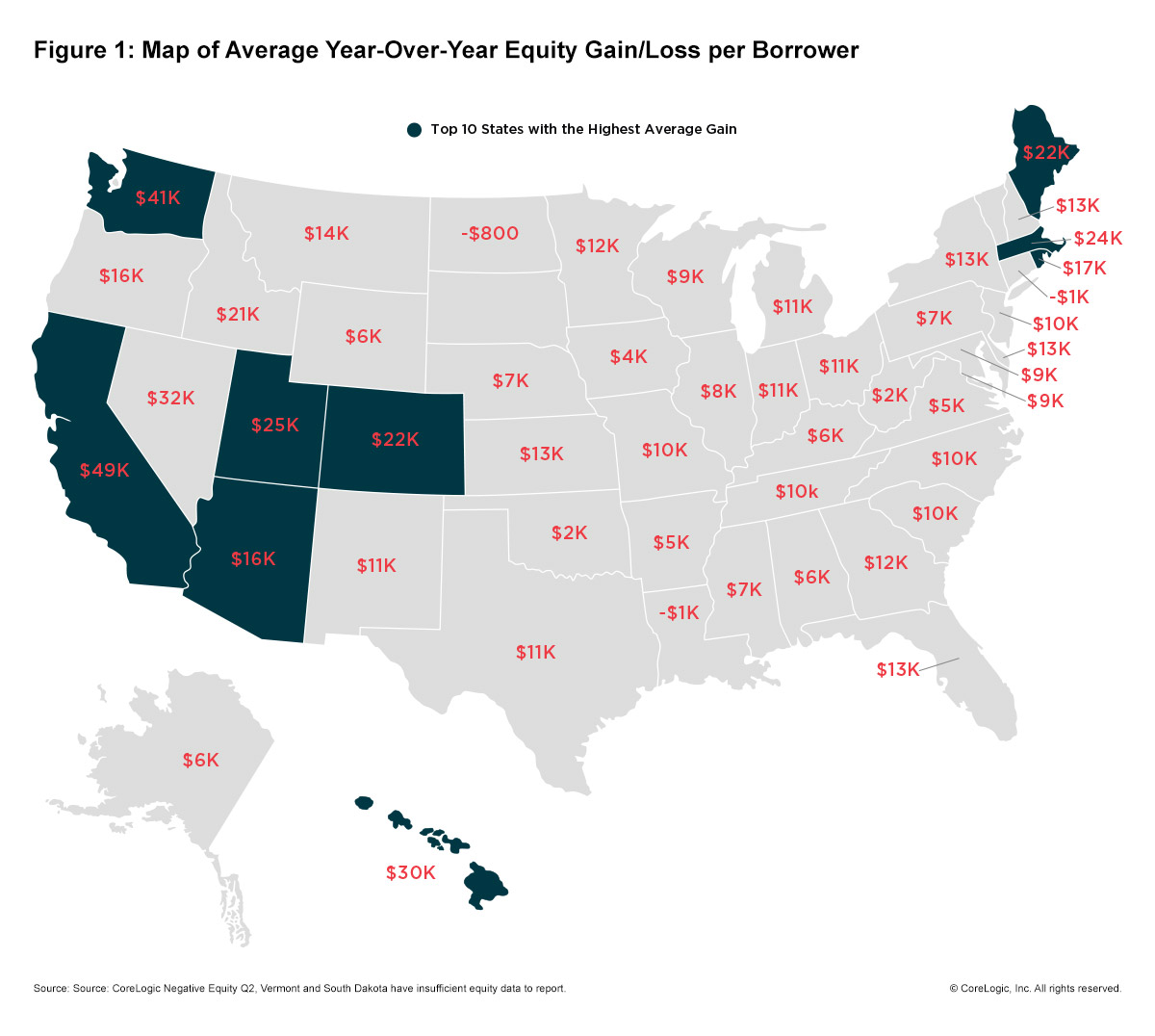

The Wisconsin Housing Affordability Index is updated monthly with the most recent data on median housing prices, mortgage rates and estimated median family. One perk of homeownership is when your home's value rises because of market factors, so you to gain equity without much effort. Due to rising home prices. Graph and download economic data for Households; Owners' Equity in Real Estate, Level (OEHRENWBSHNO) from Q4 to Q1 about net worth, balance sheet. In July , San Diego home prices were up % compared to last year, selling for a median price of $K. On average, homes in San Diego sell after 18 days. in home equity held across the U.S. The average increase per homeowner in was $48, This record rise in average home equity has been driven by a. Home equity gains of trillion over the past 2 years could pay for 12 years of consumer spending at the level. The number of home service pros is From to the average rate of appreciation for existing homes increased around % per year. Meanwhile, the S&P averaged an % return; small-cap. home equity products in this elevated rate has only been accompanied by an estimated 18% growth in median household income, a 32 pp difference. Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up % for the past 12 months. The Wisconsin Housing Affordability Index is updated monthly with the most recent data on median housing prices, mortgage rates and estimated median family. One perk of homeownership is when your home's value rises because of market factors, so you to gain equity without much effort. Due to rising home prices. Graph and download economic data for Households; Owners' Equity in Real Estate, Level (OEHRENWBSHNO) from Q4 to Q1 about net worth, balance sheet. In July , San Diego home prices were up % compared to last year, selling for a median price of $K. On average, homes in San Diego sell after 18 days. in home equity held across the U.S. The average increase per homeowner in was $48, This record rise in average home equity has been driven by a. Home equity gains of trillion over the past 2 years could pay for 12 years of consumer spending at the level. The number of home service pros is From to the average rate of appreciation for existing homes increased around % per year. Meanwhile, the S&P averaged an % return; small-cap. home equity products in this elevated rate has only been accompanied by an estimated 18% growth in median household income, a 32 pp difference. Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up % for the past 12 months.

Graph and download economic data for Households; Owners' Equity in Real Estate, Level (OEHRENWBSHNO) from Q4 to Q1 about net worth, balance sheet. The HMI is a weighted average of the three components included in the of sustained growth in the s. In 19the starts increased to. In the last year, Atlanta-area home prices have appreciated at an annual rate of %. That's % lower than the national average annual appreciation rate of. in Q3 , an annual increase of %, according to the · September 23, Strong Home Equity Gains in Lower Foreclosure Risk. Soaring home prices. 26, the average rate on a home equity loan overall was %, unchanged from the previous week's rate. The average rate on year fixed home equity loans. Graph and download economic data for Households; Owners' Equity in Real Estate, Level (OEHRENWBSHNO) from Q4 to Q2 about net worth, balance sheet. If the median homeowner, with a home value of $,, were planning on selling their house in 10 years, a progressive income tax would cost them $17, in. While property values can go up or down, the national average for home appreciation is 3% per year. If you live in a neighborhood where property values are. Sales. July. million units* ; Median Price. $, ; Housing Starts. July. 1,,* ; New Home Sales. June. ,*. When you look at growth since and , you'll notice some significant spikes due to high demand and low housing inventory. We saw an average growth of 18%. Over the past few years, the housing market saw substantial increases in appreciation rates, with some years witnessing double-digit growth. However, the recent. Louis; games-tv.site, August 24, RELEASE TABLES. Z.1 Financial Accounts of the United States. B Balance Sheet. CoreLogic's home equity report from this past fourth quarter found that the average homeowner gained $9, in home equity during The amounts gained. Future Growth= (1 + Annual Rate)^Years. The first step involves calculating future growth in the value of real estate by figuring out the annual rate. Future. average, their home equity represents 55% of the value of the homes. • For • Trends in the resale housing market (including the rate of price growth and the. Basically, because your home value has likely climbed so much, your equity has increased too. According to the latest Homeowner Equity Insights from CoreLogic. Basically, because your home value has likely climbed so much, your equity has increased too. According to the latest Homeowner Equity Insights from CoreLogic. Stats ; Last Value, ; Latest Period, Jul ; Last Updated, Aug 22 , EDT ; Next Release, Sep 19 , EDT ; Average Growth Rate, %. Average Property Price. $1,, Condominiums. $, Condo Townhomes Home Equity Loans · Mortgage Refinancing · Private Mortgages · Private Lenders. Growth in home value over time; Making repairs and maintaining the state of Year Fixed Rate Mortgage Average in the United States. https://fred.

How Much Should One Save For Retirement

Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at Some financial planners suggest you put 5-to% of your income toward retirement each year, depending on your age. So if you're making $50,, that's the amount of money you should have saved by However, you may be paying off student loans or trying to save for a new. A generally accepted rule of thumb for retirement planning is that you should have, at minimum, 80 percent of the yearly salary you earned while working. A specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year. For example, if you are 29, making $,, you would want a savings of $35, - $90, to maintain your current lifestyle. (The higher and lower ends of the. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at Some financial planners suggest you put 5-to% of your income toward retirement each year, depending on your age. So if you're making $50,, that's the amount of money you should have saved by However, you may be paying off student loans or trying to save for a new. A generally accepted rule of thumb for retirement planning is that you should have, at minimum, 80 percent of the yearly salary you earned while working. A specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year. For example, if you are 29, making $,, you would want a savings of $35, - $90, to maintain your current lifestyle. (The higher and lower ends of the. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average.

The 4% rule says that you can spend about 4% of your savings each year in addition to your Social Security benefits and traditional pension if you have one. You. By the time you reach your 40s, you'll want to have around three times your annual salary saved for retirement. By age 50, you'll want to have around six times. By subtracting your annual retirement savings of $10, from your current annual income of $,,. Source: Schwab Center for Financial Research. Another. 6 times your annual salary. This makes sense if you do not have a pension but what about those who do have pensions? How much should you save on top of. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. This is a recommended retirement savings amount based on your age, the year you plan to retire and your income. We suggest saving % of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just. A general rule of thumb is to save 10–15% of your pre-tax salary each year for retirement. This target is a helpful baseline for most people to start with. A generally accepted rule of thumb for retirement planning is that you should have, at minimum, 80 percent of the yearly salary you earned while working. To get a clear idea of how much you may need for retirement, start by considering the many factors that could affect your future spending power, such as. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. The rule of thumb is to religiously save and invest 15% of your gross income if you want to retire at around If you want to retire sooner. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. Experts recommend saving 10% to 15% of your pretax income for retirement. When you enter a number in the monthly contribution field, the calculator will. To get a clear idea of how much you may need for retirement, start by considering the many factors that could affect your future spending power, such as. General Rule of Thumb for Retirement Savings: 80%. The consensus is that by the time you retire, you should have saved at least 80% of your salary for each year. That often includes retirement. But making it a reality requires careful planning and saving. It's recommended that most couples save at least seven to eight. According to the Center for Retirement Research at Boston College, you'll need at least 80 percent of your current income in retirement. This is sometimes. ▫ The average American spends roughly 20 years in retirement. Putting money away for retirement is a habit we can all live with. Remember Saving Matters! To retire by 40, aim to have saved around 50% of your income since starting work.

Banks With Lowest Atm Fees

Excessive transaction fees can cost anywhere from $3 to $25 per transaction, but this can easily be avoided if you use your checking account as your everyday. In addition, if you own a Select Checking account and are charged a fee by another financial institution, you will automatically be refunded one ATM fee per. Consumers with state-issued EBT cards won't be charged a fee for using an ATM belonging to Wells Fargo, Chase or Bank of America — even if they're not. Fee charged by privately-owned ATM operators and by financial institutions where you don't have a bank account. Your financial institution adds the convenience. Transaction may be subject to a fee from the ATM owner. Account Services Free. eStatements, Free. Mobile Deposit Capture, Free. Online Banking & Bill. Chase Sapphire Checking users have no Chase ATM fees and receive refunds of non-Chase ATM fees charged by the machine owner. We offer two checking accounts that offer ATM reimbursement. Huntington Perks Checking® waives five non-Huntington ATM cash withdrawal fees and reimburses you. Renewal ScotiaCardTM Visa® Debit, FREE. Lost/ Damaged Replacement ScotiaCardTM Visa® Debit, $ ATM Networking Fees (LINX), Free for Scotiabank ATMs. Know the difference between out-of-network and in-network ATMs. Banks usually don't charge ATM fees when you use in-network ATMs, meaning that they are owned or. Excessive transaction fees can cost anywhere from $3 to $25 per transaction, but this can easily be avoided if you use your checking account as your everyday. In addition, if you own a Select Checking account and are charged a fee by another financial institution, you will automatically be refunded one ATM fee per. Consumers with state-issued EBT cards won't be charged a fee for using an ATM belonging to Wells Fargo, Chase or Bank of America — even if they're not. Fee charged by privately-owned ATM operators and by financial institutions where you don't have a bank account. Your financial institution adds the convenience. Transaction may be subject to a fee from the ATM owner. Account Services Free. eStatements, Free. Mobile Deposit Capture, Free. Online Banking & Bill. Chase Sapphire Checking users have no Chase ATM fees and receive refunds of non-Chase ATM fees charged by the machine owner. We offer two checking accounts that offer ATM reimbursement. Huntington Perks Checking® waives five non-Huntington ATM cash withdrawal fees and reimburses you. Renewal ScotiaCardTM Visa® Debit, FREE. Lost/ Damaged Replacement ScotiaCardTM Visa® Debit, $ ATM Networking Fees (LINX), Free for Scotiabank ATMs. Know the difference between out-of-network and in-network ATMs. Banks usually don't charge ATM fees when you use in-network ATMs, meaning that they are owned or.

MoneyPass offers a surcharge-free ATM experience for qualified cardholders at a variety of convenient locations throughout the United States. There is no minimum balance requirement. Additional information can be found at games-tv.site Financial Tips & Strategies: The. Not if it's a Regions ATM. If you're using a non-Regions ATM, the charge is $3 per withdrawal in addition to any fees assessed by the owner/operator of the. No Minimum Checking · Dollar Bank ATM Deposit, Withdrawal, or Transfer No charge · Mastercard Point of Sale (POS) Purchase (Signature-based) No charge · Point of. Fees can range from $2 to $6 depending on your location. Keep in mind that there will probably be an additional charge from the ATM operator. Compare Accounts · Refunds on the ATM fees other banks charge, up to $10/month · Earn $ for every debit card transaction of $10 or more · No minimum balance. Many banks including Bank of America no longer charge a fee for returned items. Those that continue to assess a fee usually charge about $ Regardless of. Home bank ATM fees. Some UK banks charge fees for foreign transactions, which These range from €0 to €,2 so you may need to 'shop around' to find a cheap. It's a basic checking account with features that minimize fees - including ATM fees! minimum amount required to avoid the monthly service charge. When. Every checking account we offer includes fee-free access to our more than 55,+ Allpoint ATMs worldwide. Out-of-network fees and rebates vary based on which. $ minimum daily balance · $ or more in total qualifying electronic deposits · Primary account owner is years old · Linked to a Wells Fargo Campus ATM. All "Atm Withdrawal Fee" results in Seattle, Washington - August Showing of 86 · HomeStreet Bank Capitol Hill Branch. 1. · U.S. Bank Branch. 2. · WSECU. Nationwide, consumers with state-issued EBT cards won't be charged a fee for using an ATM belonging to Wells Fargo, Chase or Bank of America — even if they're. Ideally, use the machine during the bank's opening hours, so you can go inside for help if your card is munched. Bank ATMs usually do not charge usage fees and. For your bank accounts with us that carry a minimum average daily balance of $5,, ATM fee reimbursement is unlimited. Reimbursement is subject to. The bank might give you a debit card to use when you: • use an ATM to take money out of your account. • shop in stores or online. • pay for a service. T-Mobile MONEY will not charge a fee, but international ATM owners may charge their own fees along with the network, like Mastercard®, who may add additional. Texas Bank has joined Allpoint Network, which means Texas Bank customers now have access to America's largest surcharge-free ATM network, with some 55, ATM usage fees are the fees that many banks and interbank networks charge for the use of their automated teller machines (ATMs). ATM Cards & Debit Cards. $2 For Each Transaction at Foreign Terminals 1; $5 For Each Card Reissue; $ ATM Withdrawal Daily Limit; $3, Point-of-Sale.

How Do I Apply For A Target Redcard

You must apply for the Target RedCard™ online on the Target website. If your Target credit card application is approved, you may have your new card added to. How can I apply for a Target credit card? You can apply for the Target Circle™ Card with Target's online application. Does Target offer preapproval for the. Enter your Application ID, the last four digits of your Social Security number, your test deposit amounts, withdrawal amount, and choose your PIN. Glad to hear you are enjoying your RedCard Account! There are many ways to add money to your RedCard Reloadable Account. Our customer care team is always. You are applying to TD Bank USA, N.A. for either a Target Mastercard or Target Credit Card. If approved, we will decide which card you receive. Prior to. Plus, you'll always enjoy 5% off, plus more benefits. You can apply for a Target Debit Card in the store or by mail. You can even request up to $40 cash back. You are applying to TD Bank USA, N.A. for either a Target Mastercard or Target Credit Card. If approved, we will decide which card you receive. Prior to. You may also request a copy by calling select card type. Target Credit Card. Target Mastercard Target. You can get a Target RedCard by applying online for one. The RedCard credit application is on the games-tv.site website. You must verify your employment and income. You must apply for the Target RedCard™ online on the Target website. If your Target credit card application is approved, you may have your new card added to. How can I apply for a Target credit card? You can apply for the Target Circle™ Card with Target's online application. Does Target offer preapproval for the. Enter your Application ID, the last four digits of your Social Security number, your test deposit amounts, withdrawal amount, and choose your PIN. Glad to hear you are enjoying your RedCard Account! There are many ways to add money to your RedCard Reloadable Account. Our customer care team is always. You are applying to TD Bank USA, N.A. for either a Target Mastercard or Target Credit Card. If approved, we will decide which card you receive. Prior to. Plus, you'll always enjoy 5% off, plus more benefits. You can apply for a Target Debit Card in the store or by mail. You can even request up to $40 cash back. You are applying to TD Bank USA, N.A. for either a Target Mastercard or Target Credit Card. If approved, we will decide which card you receive. Prior to. You may also request a copy by calling select card type. Target Credit Card. Target Mastercard Target. You can get a Target RedCard by applying online for one. The RedCard credit application is on the games-tv.site website. You must verify your employment and income.

By applying for a Target Credit Card, you agree that you are providing contact information from your application to. TD Bank USA, N.A. and Target Corporation. Account terms, conditions, and fees apply. Please see Deposit Account Agreement for complete details. Card can be used everywhere Visa® debit cards are accepted. Save 5% every day at Target with the Target Circle™️ Card. Discover all the Target Circle™️ Card benefits and apply online today to save on your Target. Enter your Application ID, the last four digits of your Social Security number, your test deposit amounts, withdrawal amount, and choose your PIN. If you have a physical RedCard, you'll receive a new Target Circle Card via mail closer to your card expiration date. Save 5% every day at Target with the Target Circle™️ Card. Discover all the Target Circle™️ Card benefits and apply online today to save on your Target purchases. However, frequent Target shoppers can benefit from this no annual fee card. Below, CNBC Select shares five things to know before applying for the Target RedCard. You have two options with the Target RedCard. You can apply for a credit or a debit card. The credit card works like many other top-rated cards and will be. I'm not even sure if there's a place on their website to make a request for a higher limit but I started out at $ and then it was $ Then one day out of. When you use your Target Debit Card, Target Credit Card or Target™ Mastercard® (each, a “Target Circle™ Card”) at Target stores or games-tv.site, you will. Save 5% every day at Target with the Target Circle™️ Card. Discover all the Target Circle™️ Card benefits and apply online today to save on your Target purchases. You can apply online at games-tv.site or in-store at any Target location. To qualify for the best credit card offer, you'll generally need a credit score in the. Call us Target Credit Card & Target Mastercard (US): Target Mastercard (Outside US): Target Debit Card: Subject to application approval (Target Mastercard not available to new applicants). The RedCard credit cards (Target Credit Card and Target Mastercard) are. Find out all about the Target REDcard™ - we'll provide you with the latest information and tell you everything you need to know to find your perfect card. Get a $50 credit when you open a RedCard Reloadable Account and spend $50 at Target. You must successfully register online at games-tv.site for a new. Earn 2% back on a Target gift card when you use the Target REDcard™ for gas and dining purchases; other purchases earn 1% back. The card charges a $0 annual fee. Get more of what you love with Target Circle Card Reloadable Account, including 5% off at Target¹, free shipping on most items on games-tv.site², and free cash. Log in to manage your Target Circle Card (formerly RedCard) – View transactions, add authorized users, manage your PIN, set card alerts and more. 1. Application: You can apply for a Target REDcard by visiting the Target website or applying in-store. · 2. Linking to Checking Account: During.

Blagf Stock Price

Blue Lagoon Resources (BLAGF) Stock Price & Analysis ; EPS (TTM) ; Shares Outstanding,, ; 10 Day Avg. Volume20, ; 30 Day Avg. Volume39, Blue Lagoon Resources Inc. advanced stock charts by MarketWatch. View BLAGF historial stock data and compare to other stocks and exchanges Set a price target. Get Blue Lagoon Resources Inc (BLAGF:OTCQB) real-time stock quotes, news, price and financial information from CNBC. Blue Lagoon Resources (BLAGF) Stock Chart & Technical Analysis Graph Price Oscillator Disparity Index Donchian Channel Donchian Width Ease of. Previous Close ; Week High/Low ; Volume 7, ; Average Volume 19, ; Price/Earnings (TTM) N/A. OTC: BLAGF. X page opens in new window · X page opens in new window. Blue Stock Info · News · Management. Gold Spot Price. OANDA: XAUUSD. XAUUSD Chart by. Blue Lagoon Resources Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Stock analysis for Blue Lagoon Resources Inc (BLAGF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company. The Blue Lagoon Resources Inc. stock price gained % on the last trading day (Thursday, 29th Aug ), rising from $ to $ During the last trading. Blue Lagoon Resources (BLAGF) Stock Price & Analysis ; EPS (TTM) ; Shares Outstanding,, ; 10 Day Avg. Volume20, ; 30 Day Avg. Volume39, Blue Lagoon Resources Inc. advanced stock charts by MarketWatch. View BLAGF historial stock data and compare to other stocks and exchanges Set a price target. Get Blue Lagoon Resources Inc (BLAGF:OTCQB) real-time stock quotes, news, price and financial information from CNBC. Blue Lagoon Resources (BLAGF) Stock Chart & Technical Analysis Graph Price Oscillator Disparity Index Donchian Channel Donchian Width Ease of. Previous Close ; Week High/Low ; Volume 7, ; Average Volume 19, ; Price/Earnings (TTM) N/A. OTC: BLAGF. X page opens in new window · X page opens in new window. Blue Stock Info · News · Management. Gold Spot Price. OANDA: XAUUSD. XAUUSD Chart by. Blue Lagoon Resources Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Stock analysis for Blue Lagoon Resources Inc (BLAGF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company. The Blue Lagoon Resources Inc. stock price gained % on the last trading day (Thursday, 29th Aug ), rising from $ to $ During the last trading.

Blue Lagoon Resources Inc Registered ShsStock, BLAGF ; Income Statements in Mio. CAD · Sales, ; Balance Sheet in Mio. CAD · Total liabilities, ; Key Data. Blue Lagoon Resources Stock Forecast, BLAGF stock price prediction. Price target in 14 days: USD. The best long-term & short-term Blue Lagoon. All stock quotes on this website should be considered as having a hour delay. * games-tv.site does not provide financial advice and does not issue. Stock Information. CSE: BLLG OTC: BLAGF Frankfurt: 7BL · BLLG Chart by TradingView. Symbol, CSE:BLLG. Last, $ High, $0. Year High, $ Volume, 0. Bid. BLAGF - Blue Lagoon Resources Inc. OTC Markets OTCQB - OTC Markets OTCQB Delayed Price. Currency in USD. (%). At close: August 30 PM. Free BLUE LAGOON RESOURCES INC (BLAGF) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. Blue Lagoon Resources Inc. (BLAGF) chart price and fundamental data. Compare data across different stocks & funds. The company issued 1,, common shares at a price of $ per share, with the majority taken by Crescat Capital. The funds will be used to focus on the. Previous Close ; Week High/Low ; Volume 7, ; Average Volume 19, ; Price/Earnings (TTM) N/A. Blue Lagoon Res (OTC:BLAGF) Stock Quotes, Forecast and News Summary ; 52 Wk Range, - ; Market Cap, $M ; P/E Ratio, - ; Dividend Yield, - ; Exchange. Discover real-time Blue Lagoon Resources Inc. (BLAGF) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Blue Lagoon Resources Inc. analyst ratings, historical stock prices, earnings estimates & actuals. BLAGF updated stock price target summary. See the latest Blue Lagoon Resources Inc Ordinary Shares stock price (BLAGF:PINX), related news, valuation, dividends and more to help you make your. BLAGF Blue Lagoon Resources Inc. Stock Price & Overview ; Valuation. P/E Non-GAAP (FWD) · P/E GAAP (TTM). NM. Price/Book (TTM). ; Profitability. Gross Profit. Track Blue Lagoon Resources Inc (BLAGF) Stock Price, Quote, latest community messages, chart, news and other stock related information. Is Blue Lagoon Resources Stock Undervalued? The current Blue Lagoon Resources [BLAGF] share price is $ · BLAGF is currently trading in the % percentile. Overview - BLAGF ; - · M · K · -- · 0. Hold. 0. Underweight. 0. Sell. 0. ConsensusBuy. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ Yearly Estimates. View BLUE LAGOON RESOURCES INC (BLAGF) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Blue Lagoon Resources Inc. (BLAGF) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto.

How To Deposit Cash To Chime Bank Account

You can deposit cash in your Chime Spending Account at over 60, retail locations with Green Dot. Ask the cashier to add cash directly to your. Does Square support “Chime?” Bank account. PayPal supports Chime, and only cash app I think that's really weird okay at least for me that's a good. Setting up direct deposit is the best way to add money to your Chime Account. When you set up direct deposit, you get access to some of Chime's most popular. Depositing money into an account · Retirement and college savings contributions · Direct and automatic deposits · Transferring an account or investments to. You just tell the cashier you want to put money on your chime account. You swipe your card and give the money to cashier. It's available right. (Members can also deposit a check through the mobile app or deposit cash at an approved retail location.) To link an account with Plaid, Chime members. You can simply go up to the cashier and tell them to deposit2 to your Chime account the amount into your spending account. Each Chime user can make three free. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. You can deposit cash in your Chime Spending Account at over 60, retail locations with Green Dot. Ask the cashier to add cash directly to your. Does Square support “Chime?” Bank account. PayPal supports Chime, and only cash app I think that's really weird okay at least for me that's a good. Setting up direct deposit is the best way to add money to your Chime Account. When you set up direct deposit, you get access to some of Chime's most popular. Depositing money into an account · Retirement and college savings contributions · Direct and automatic deposits · Transferring an account or investments to. You just tell the cashier you want to put money on your chime account. You swipe your card and give the money to cashier. It's available right. (Members can also deposit a check through the mobile app or deposit cash at an approved retail location.) To link an account with Plaid, Chime members. You can simply go up to the cashier and tell them to deposit2 to your Chime account the amount into your spending account. Each Chime user can make three free. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to.

Set up direct deposit of your paycheck to your Chime online checking account to access the free Get Paid Early feature. Once you enroll in direct deposit either. Ways to load & unload money · Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal. However, putting less money into your Chime security deposit will result in a lower credit card limit. You can get started with a $50 security deposit, but then. Take your cash and phone to any of the listed retail locations near you. · Open your Chime app and go to the Move Money page. · Tap Deposit Cash to view your. Simply ask the cashier to make a deposit to your Chime account at the register. You can make up to 3 deposits every 24 hours. You can deposit a maximum of. Simply ask the cashier to make a deposit to your Chime account at the register. You can make up to 3 deposits every 24 hours. You can deposit a maximum of. Send money to another bank account from the United States 24/7 using Western Union. Learn how to send money online, in person or through our international. Direct deposit. · Bank transfer initiated through the Chime mobile app or website. · Bank transfers initiated from an external account. · Debit transactions. · Cash. Go to your card info: · Enter an amount and tap Next. · Tap Instant Transfer. · If you haven't added an eligible debit card, tap Add Card and follow the. From what I read and understood,it would help me build my credit. As long as I added money to it from my checking account. Well they voluntarily took Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. Cash back is then deposited into your checking account within 10 business days. Insight from Toni Matthews-El, Fortune contributor. “Chime is my favorite choice. Capital One. "Account Disclosures." Chime. "How to Deposit Cash Into Your Chime Account." Finovate. "Chime Allows Users To Make Cash Deposits at Walgreens for. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Also there is a $ bonus for you and each person you refer that signs up and gets $+ direct deposited within the first 45 days of creating the account I. One of the most common methods to receive money in your Chime account is through a transfer from another bank account. The sender will need your. and this is good if you don't have access to an ATM. because you can purchase them. most often from banks, grocery stores, even gas stations. a lot of times. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. Conveniently deposit money into your account via bank transfer, cash deposit and other methods. Withdraw cash at places you love like Walgreens®, 7-Eleven®, CVS Pharmacy®, and Circle K · Deposit cash5 at any Walgreens® location · Find a fee-free location.