games-tv.site

Community

Louisiana Pacific

Louisiana-Pacific Corporation's stock symbol is LPX and currently trades under NYSE. It's current price per share is approximately $ What are. Louisiana-Pacific Corporation (LP) is an American building materials manufacturer. The company was founded in and LP pioneered the U.S. production of. Louisiana-Pacific Corporation is a provider of building solutions. The Company manufactures engineered wood building products that meet the demands of. The National Advertising Division (NAD) determined one Louisiana-Pacific claim was supported while others should be modified or discontinued. Louisiana-Pacific Corporation is a provider of building solutions. The Company manufactures engineered wood building products that meet the demands of. Get more information for Louisiana Pacific Corporation in Nashville, TN. See reviews, map, get the address, and find directions. Find Louisiana-Pacific Corporation and its complete list of construction products on BuildSite. Start your search here. Louisiana Pacific Corp. announced plans to cut jobs at the company's plant in Roaring River Thursday in connection with a shift in production there. Louisiana-Pacific is primarily an oriented strand board producer and also offers engineered wood siding used in home construction and repair and remodel. Louisiana-Pacific Corporation's stock symbol is LPX and currently trades under NYSE. It's current price per share is approximately $ What are. Louisiana-Pacific Corporation (LP) is an American building materials manufacturer. The company was founded in and LP pioneered the U.S. production of. Louisiana-Pacific Corporation is a provider of building solutions. The Company manufactures engineered wood building products that meet the demands of. The National Advertising Division (NAD) determined one Louisiana-Pacific claim was supported while others should be modified or discontinued. Louisiana-Pacific Corporation is a provider of building solutions. The Company manufactures engineered wood building products that meet the demands of. Get more information for Louisiana Pacific Corporation in Nashville, TN. See reviews, map, get the address, and find directions. Find Louisiana-Pacific Corporation and its complete list of construction products on BuildSite. Start your search here. Louisiana Pacific Corp. announced plans to cut jobs at the company's plant in Roaring River Thursday in connection with a shift in production there. Louisiana-Pacific is primarily an oriented strand board producer and also offers engineered wood siding used in home construction and repair and remodel.

Louisiana-Pacific Corporation | Manufacturing, Distribution, Processing. Louisiana-Pacific Corporation (LP). About. At LP Building Solutions, we're about world-class solutions for better building. Our team is engineering premium. Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions primarily for use in new home construction, repair and remodeling. 64 Louisiana-Pacific Corporation (LP Building Solutions) jobs. Apply to the latest jobs near you. Learn about salary, employee reviews, interviews. Louisiana-Pacific Corp. engages in the provision of building solutions. It operates through the following segments: Siding, Oriented Strand Board (OSB), LP. The Louisiana-Pacific Corp. site consists of two pieces of property located a half-mile apart: a acre wood processing plant and a acre landfill. Georgia. See the company profile for Louisiana-Pacific Corporation (LPX) including business summary, industry/sector information, number of employees. Louisiana-Pacific Corporation | West End Ave, Ste , Nashville, TN, | As a leader in high-performance building solutions, Louisiana-Pacific. Louisiana Pacific-Two Harbors, Two Harbors, MN. 22 likes · were here. Local business. Company Research Report: Louisiana-Pacific Corporation. Company details, financials, key personnel, industries of involvement, service providers and more. Stock analysis for Louisiana-Pacific Corp (LPX:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Most Recent Annual Report. Louisiana-Pacific Corp. Louisiana-Pacific Corp. does not currently have any hardcopy reports on games-tv.site Click the button. Louisiana-Pacific Corporation | followers on LinkedIn. LP Building Solutions | As a proven leader in high performance building solutions. Unique Site ID: Company Name: Louisiana-Pacific Corporation, Tradestyle: LP Building Products. Top Contact: Restricted, Title: Restricted. Louisiana-Pacific Corp. engages in the provision of building solutions. It operates through the following segments: Siding, Oriented Strand Board (OSB), South. Related keylists Louisiana-Pacific Corp (LP) is a manufacturer of building materials. It provides building solutions to builders, remodelers, and homeowners. Building products maker Louisiana-Pacific Corp. said Thursday it will cut back on operations at five North American mills due to very low product demand and. What You Need to Know About the LP Siding Recall · A Brief History of Louisiana-Pacific (LP) Siding · Already know you have LP Inner-Seal Siding that needs repair. Louisiana-Pacific Corp headquarters address, phone number and website information and details on other Louisiana-Pacific Corp's locations and subsidiaries. Capgemini today announced that it successfully migrated Louisiana Pacific Corporation's (LP) SAP landscape to Amazon Web Services (AWS) in less than four.

If You Get A Ticket Does Your Insurance Go Up

Your driving record plays a big role in your insurance premiums. So in most cases, yes, getting a speeding ticket will likely increase what you pay for car. Driving Record - California traffic tickets and accidents on your driving record can cause auto insurance increases. If you've done it before, odds show that. The short answer is: It depends. Though a speeding ticket could raise your auto insurance rate, your rate may not be affected at all. For speeding tickets or other minor infractions, your insurance will probably go back to normal within 6 months to 7 years. If you have received a traffic ticket, your insurance rate may rise unless you hire a skilled New York lawyer to fight your charges. Call our firm today! In general, the number of demerit points you have will not affect your car insurance rate, but the number and severity of the tickets you accumulate will. As a result, they may increase your premiums to offset this perceived risk. In New York, the Department of Motor Vehicles (DMV) keeps track of traffic. Getting a speeding ticket or other type of traffic ticket can make already high premiums even higher. Obviously, a lot depends on your prior record, the type of. Driving Record - California traffic tickets and accidents on your driving record can cause auto insurance increases. If you've done it before, odds show that. Your driving record plays a big role in your insurance premiums. So in most cases, yes, getting a speeding ticket will likely increase what you pay for car. Driving Record - California traffic tickets and accidents on your driving record can cause auto insurance increases. If you've done it before, odds show that. The short answer is: It depends. Though a speeding ticket could raise your auto insurance rate, your rate may not be affected at all. For speeding tickets or other minor infractions, your insurance will probably go back to normal within 6 months to 7 years. If you have received a traffic ticket, your insurance rate may rise unless you hire a skilled New York lawyer to fight your charges. Call our firm today! In general, the number of demerit points you have will not affect your car insurance rate, but the number and severity of the tickets you accumulate will. As a result, they may increase your premiums to offset this perceived risk. In New York, the Department of Motor Vehicles (DMV) keeps track of traffic. Getting a speeding ticket or other type of traffic ticket can make already high premiums even higher. Obviously, a lot depends on your prior record, the type of. Driving Record - California traffic tickets and accidents on your driving record can cause auto insurance increases. If you've done it before, odds show that.

By not paying the ticket, and by choosing to fight it, you stand a very good chance of keeping a conviction from appearing on your driving record. Experts say that a single ticket can leave you with a rate hike of anywhere between 7 and 28%. All told, you're probably looking at paying at least a couple. In conclusion, while receiving a speeding ticket can lead to an increase in your auto insurance premiums, the impact is not permanent. By maintaining a clean. Minor offenses, such as a single speeding ticket, may lead to a small increase in your premiums. However, multiple tickets or serious violations, like DUI . If you get one speeding ticket, it should not affect the price of your insurance if you have not had any claims. If you get another kind of. Your insurance rate may go up due to a speeding ticket once your policy renews, since insurers typically review your Motor Vehicle Record (MVR) at policy. If you do end up with points on your license from past traffic violations, your auto premiums may increase upon renewal. Your driving record is a major factor. Just like speeding ticket amounts vary from state to state, the amount your car insurance premium may increase will vary depending on your driving record. How much does car insurance go up after a speeding ticket? It depends. Factors like your insurer, how many other speeding tickets you have, and your location. If you do end up with points on your license from past traffic violations, your auto premiums may increase upon renewal. Your driving record is a major factor. Your Insurance Rate Could Increase Sadly, a traffic ticket can have financial consequences beyond the fines you'll pay. Your insurance company may increase. Car insurance rates usually increase only if you were traveling at least 15 mph above the speed limit. State laws also factor in, as many states have. Even a simple ticket that only adds one insurance point to your record can result in a 30 percent increase in your insurance costs. Because of this, you should. So let's be straightforward here: yes, a ticket will almost definitely raise your car insurance rate in Texas. But that's only true if you don't do anything. It's not easy to predict exactly how much a traffic ticket will cause your insurance premium to rise, but generally, the more moving violations you have on. Going between 1 and 14 miles per hour over the speed limit will statistically increase your insurance rate by 11 percent. Depending on your insurance company, your rates might not increase with one ticket if you have been a loyal customer and you have had a previously clean driving. These recorded violations (like speeding tickets) can cause a steep increase in the rates that you pay for insurance. games-tv.site estimates that a single. Fact, traffic tickets have costly fines, but they can also cause insurance rate increases. Drivers with current traffic tickets on their record, or accidents. Even a first offense can cause your rates to increase substantially, as an average speeding violation increases rates by about $ per year. Essentially, if.

Best Penny Stocks 2022

Top Penny Stock Gainers ; CDT. Conduit Pharmaceuticals ; MDNAF. Medicenna Therapeutics Corp ; BUKS. Butler National ; EDAP. EDAP TMS. For me, short-term trading versus long-term investing has proven the best approach to penny stocks. Comments (22). Michael French○Apr. 06, at pm. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · games-tv.site (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. Penny Stocks For Dummies Cheat Sheet. By: Peter Leeds and. Updated: Crucial criteria found in great penny stocks. When you find a penny stock. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · games-tv.site (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. What Is A Penny Stock? The Difference Between OTC, NYSE, & NASDAQ Penny Stocks; Beginner's Guide To Trading Penny Stocks; How To Find The Best Penny Stocks. Best Penny Stocks - Cybin Inc. The Canada-based biopharmaceutical company focuses on the development of psychedelic-based therapeutics to be used in the. The list of the best stocks that can give a % return in · JITF Intralogistics Ltd · ANG Lifesciences · Orchid Pharma · 3i Infotech · Authum. Best Penny Stocks for ; Lucky Block, Crypto, $ ; Orosil Smiths India, Jewellery, $ ; Tine Agro, Textile, $ ; Arc Finance Ltd, Finance, $. Top Penny Stock Gainers ; CDT. Conduit Pharmaceuticals ; MDNAF. Medicenna Therapeutics Corp ; BUKS. Butler National ; EDAP. EDAP TMS. For me, short-term trading versus long-term investing has proven the best approach to penny stocks. Comments (22). Michael French○Apr. 06, at pm. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · games-tv.site (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. Penny Stocks For Dummies Cheat Sheet. By: Peter Leeds and. Updated: Crucial criteria found in great penny stocks. When you find a penny stock. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · games-tv.site (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. What Is A Penny Stock? The Difference Between OTC, NYSE, & NASDAQ Penny Stocks; Beginner's Guide To Trading Penny Stocks; How To Find The Best Penny Stocks. Best Penny Stocks - Cybin Inc. The Canada-based biopharmaceutical company focuses on the development of psychedelic-based therapeutics to be used in the. The list of the best stocks that can give a % return in · JITF Intralogistics Ltd · ANG Lifesciences · Orchid Pharma · 3i Infotech · Authum. Best Penny Stocks for ; Lucky Block, Crypto, $ ; Orosil Smiths India, Jewellery, $ ; Tine Agro, Textile, $ ; Arc Finance Ltd, Finance, $.

penny stock jan · 1. Monotype India, , , , , , , , , · 2. Seven Hill Inds. , , , Best Sellers Rank. #, in Books (See Top in Books). # in Reviewed in the United States on March 25, In the world of penny stock. But it's also important to know how to find GOOD penny stocks. After going Our winner for (those picks are up now %); strong in and. Xiuxian Du (Steven Dux). Day Trader | Mentor | Gamer | I teach people to Published Apr 1, + Follow. As I'm sure you already know penny stocks are an. Find and compare the best penny stocks under $2 in real time. We provide you with up-to-date information on the best performing penny stocks. My top 3 penny stocks to buy now (as long as their price action is strong) are BranchOut Food Inc (NASDAQ: BOF), Neonode Inc (NASDAQ: NEON), and AST SpaceMobile. Chris's top penny stock right now is Lightwave Logic Inc. (OTC: LWLG). Lightwave Logic is an Internet infrastructure company. Penny stocks to buy under $1 · $BTC Digital (games-tv.site)$ · $Exela Technologies (games-tv.site)$ · $ProQR Therapeutics (games-tv.site)$ · $Cybin (games-tv.site)$ · $Statera Biopharma . Penny Stocks: Explore the Best Penny Stock Companies in India to Buy Your security and privacy are our top priority! ISO Certification Icon. This list shouldn't be construed as financial advice. Many of these penny stocks have been hit by the wider market downturn since the start of However. Best Long-term Penny Stock – Genius Brands (Nasdaq:GNUS) For investors concerned that Smiths News is currently targeting an ageing demographic, Genius Brands. The Best Penny Stocks · ASRT · BDSI · SBEV · AUMN · NGD · LCLP · TONR · AHFD. Penny stocks that provide returns several times over the initial investment, often multiplying the invested capital by two, three, or more times, are called. Best Penny Stocks in India with Strong Fundamentals!! - A Thread Hit 'Retweet' to help us reach more audience. (1/9) #StockMarket. Penny Stocks To Watch · Gevo Inc. (NASDAQ: GEVO) · Sunworks Inc. (NASDAQ: SUNW) · T2 Biosystems (NASDAQ: TTOO) · Akanda Corp. (NASDAQ: AKAN). Penny stocks are generally stocks that trade at less than five dollars a District of Columbia. Stocks · What is CPR in Trading. 27 August 3 min read. What is Dabba Trading · Markets · What is Dabba Trading. 26 August 4 min read. What is Gap Up. votes, comments. Hey gents, I've gotten back into penny stocks recently and have started paying close attention to upcoming. Penny stocks are generally stocks that trade at less than five dollars a District of Columbia. The 10 Best Penny Stocks · 1 - Chesapeake Energy (OTCMKTS: CHKAQ) · 2 - Mid-Con Energy Partners LP (NASDAQ: MCEP) · 3 - Advantage Oil and Gas Ltd. (NYSE: AAV) · 4 -.

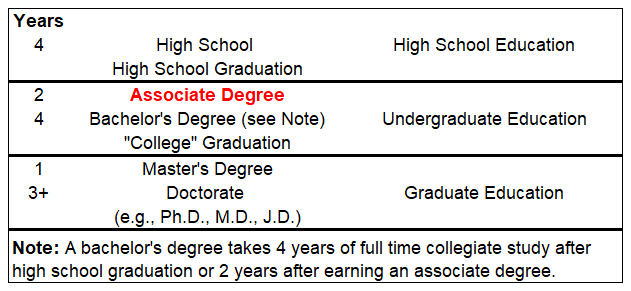

How Fast Can You Finish An Associate Degree

Online associate degrees may be completed in as little as a year, or they may take four years or longer to finish. Factors That May Affect the Length of Your. In this article, we explore the potential time frames and strategies for earning an associate degree online, offering insights into how students can optimize. An associate degree generally takes an average full-time student 2 years to finish, but by choosing a university that provides flexible transfer credits and. With an ADT you will be able to earn two degrees — your associate's degree and your bachelor's degree — with only units if you transfer into a program. A minimum of 60 credit hours is required for graduation with an associate degree. Students should check the program's graduation audit and major map for. I have an AAS in electrical technology, and had to go back and complete a number of general education classes for my degree. With an AA or AS, you complete all. The majority of associate degree students graduate from a junior college or trade school in just 18 to 28 months. This short timeline bodes very well for. I have an AAS in electrical technology, and had to go back and complete a number of general education classes for my degree. With an AA or AS, you complete all. So, it's probably more realistic that you'll complete your Associate's degree in as little as 1 year and 3 months, with 1 year and 6 months being most realistic. Online associate degrees may be completed in as little as a year, or they may take four years or longer to finish. Factors That May Affect the Length of Your. In this article, we explore the potential time frames and strategies for earning an associate degree online, offering insights into how students can optimize. An associate degree generally takes an average full-time student 2 years to finish, but by choosing a university that provides flexible transfer credits and. With an ADT you will be able to earn two degrees — your associate's degree and your bachelor's degree — with only units if you transfer into a program. A minimum of 60 credit hours is required for graduation with an associate degree. Students should check the program's graduation audit and major map for. I have an AAS in electrical technology, and had to go back and complete a number of general education classes for my degree. With an AA or AS, you complete all. The majority of associate degree students graduate from a junior college or trade school in just 18 to 28 months. This short timeline bodes very well for. I have an AAS in electrical technology, and had to go back and complete a number of general education classes for my degree. With an AA or AS, you complete all. So, it's probably more realistic that you'll complete your Associate's degree in as little as 1 year and 3 months, with 1 year and 6 months being most realistic.

These credit hour associate degrees can be completed in 16 months or four semesters if the full-time student attends online classes for 20 months or five. Regardless, you'll need a high school diploma to apply (or the equivalent). You might also be wondering how many credits you'll need to complete an associate's. Because these college degrees are typically completed in 1 to 2 years, an associate's degree program can help you enter the workforce sooner than committing to. At St Petersburg College, you can earn an Associate Degree in less than two years and transfer your credits to other universities. An accelerated associate degree features a more rigorous curriculum than traditional programs, but you'll be able to get your diploma in just 12 months. Conferred by community colleges upon completion of major and general education courses. Those students who are interested in pursuing an A.S. degree must. An associate degree for transfer from a California community college gives you a guaranteed spot at a four-year university. What happens if it takes me longer than six months to complete each of the semesters? Faster learners, or those with more time to dedicate to their coursework, can finish in as little as 5 months per semester. The estimated completion times per. An associate's degree is a two-year degree, typically offered at a community college. These programs tend to focus on general studies with an employment-based. In this article, we explore the potential time frames and strategies for earning an associate degree online, offering insights into how students can optimize. There is ample room to bring in credits. If you have your associate's degree, you already have at least 60 credit hours. Degree completion programs usually. An Associate in Art or Science is often referred to as a transfer degree. Most of these 2-year programs are designed to give you exactly half of the credits. Well, an associates degree is often considered half of a bachelors. It is a milestone that signifies you have achieved some general education requirements as. they were admitted into, will be invited to participate in the California Promise Program. This program will allow students to finish their bachelor's. Earn your associate in art degree in one year! Choose to take classes in person, online, or hybrid; it's up to you! Enroll each year in the spring or fall. Many associate's degree students choose to study part-time, which of course means the degree will take longer to complete. On the other hand, it's also possible. Graduation generally requires the equivalent of two years of full-time study which leads to an Associate in Science (A.S.) or Associate in Arts (A.A.) degree. Designed to be completed in as little as 2 years – or even faster if you have transfer credits – the associate degree is an attractive option for learners.

Minimum Payment On 2000 Credit Card

A minimum credit card payment is exactly what it sounds like — it's the minimum amount you can pay on your bill to remain in good standing with your issuer. Use this calculator to see what it will take to pay off your credit card balance, and what you can change to meet your repayment goals. Use this guide to learn what credit card minimum payments are, how they work and how they're calculated. Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated loan. Min. monthly payment. Min. In fact, unlike a traditional credit card with a set limit, the amount you You must pay at least the Minimum Payment Due, which includes your Pay. If you're only paying your minimum monthly balance though, interest charges can quickly get out of control. This can especially be true if you have a rewards. Meaning you will give the bank/credit card issuer more of your money. For example, a $ purchase at % interest with an $80 minimum. minimum payment. But if there's a month that you have extra money left over You could pay off the extra $2, in charges on the 2nd, and lower. What happens when you only pay the minimum on your credit card bill? · You'll accrue interest charges: If you pay only the minimum, this will likely result in. A minimum credit card payment is exactly what it sounds like — it's the minimum amount you can pay on your bill to remain in good standing with your issuer. Use this calculator to see what it will take to pay off your credit card balance, and what you can change to meet your repayment goals. Use this guide to learn what credit card minimum payments are, how they work and how they're calculated. Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated loan. Min. monthly payment. Min. In fact, unlike a traditional credit card with a set limit, the amount you You must pay at least the Minimum Payment Due, which includes your Pay. If you're only paying your minimum monthly balance though, interest charges can quickly get out of control. This can especially be true if you have a rewards. Meaning you will give the bank/credit card issuer more of your money. For example, a $ purchase at % interest with an $80 minimum. minimum payment. But if there's a month that you have extra money left over You could pay off the extra $2, in charges on the 2nd, and lower. What happens when you only pay the minimum on your credit card bill? · You'll accrue interest charges: If you pay only the minimum, this will likely result in.

In truth, all credit cards require a minimum monthly payment of around 2% of the total balance. If you miss even one monthly payment, your card issuer may. Repaying Credit Card Debt Scenarios. Let's say John and Jane both have $2, balances on their credit cards, which require a minimum monthly payment of 3%, or. Credit card minimum payments. Learn the minimum monthly payment amount you need to make to your credit card and what to do if you're unable to make this payment. If you have a $2, balance, then your minimum month payment is $30 (% of $2,), but your interest payment is $47 (% of $2,). If. A minimum payment is typically around 1% to 5% of your balance, depending on the issuer. Typically, you have to pay that percentage or a dollar amount of around. "Minimum Payment" means the minimum amount you must pay by the Payment Due Date. You can find this date on each billing statement for your Account. "Payment Due. Our repayment calculator will show you how much time and interest you could save by making a small change to your monthly payments on your credit card. paying only the minimum payments has its consequences. For example, if a person charged $2, on a credit card with an eighteen percent interest rate and. How we calculate your minimum payment · Any interest charged, plus · Any default charges payable, plus · Payment protection cover/credit card repayments cover (if. How much is the minimum repayment? · Any amount you owe that exceeds your credit limit (excluding any amount by which your credit limit was exceeded in a. credit card will require payment of interest on top of the principal. The calculation of monthly payments will lead providers to charge a minimum payment. So if you do that every month, you could avoid paying interest entirely. Pay more than your minimum payment due. Every month, your credit card. Many credit card issuers allow cardholders to carry a balance month-to-month and make “minimum payments” (usually around $25 or 3% of the total balance) partly. What is your balance due? $. What is your interest rate (APR)?, %. How is your minimum payment calculated? Learn what the minimum payment on your credit card means, whether you should pay more, and how yours is calculated. Minimum repayments are designed to keep you in debt paying huge interest. See the Money Saving Expert credit card interest calculator and 3 step plan. Consider the example of a $2, balance at 18% interest. If your minimum payment is 2% of the balance due each month, it will take you about 19 years to. $1, Credit Limit, $2, Credit Limit ; $10 monthly fee, $20 monthly fee ; $45 predictable minimum payment, inclusive of the monthly fee. $1, Credit Limit, $2, Credit Limit ; $10 monthly fee, $20 monthly fee ; $45 predictable minimum payment, inclusive of the monthly fee. Repaying Credit Card Debt Scenarios. Let's say John and Jane both have $2, balances on their credit cards, which require a minimum monthly payment of 3%, or.

Aetna Dental Vs Cigna Dental

:max_bytes(150000):strip_icc()/aetna-vs-cigna-health-insurance.asp_V2-222f398d5d934526b84ed78eefde3038.png)

Dental Indemnity is a type of dental insurance that gives you a lot of freedom. It's often referred to as a “traditional” dental plan or a “fee-for-service. Aetna Leap Dental PPO. AL IVL CB-HDentalPol Dental. 12/ & SOB AL IVL CB Cigna Individual Dental PPO. HC-NOT11 et. al./HC-CER Dental. 01/ CIGNA. Benefits included in every dental plan. Plan features for the way you live. With Aetna Dental, you get: Affordable plans. Plan options start at $ Insurance Plans Accepted · Aetna, Blue Cross, MetLife, Cigna, Many More · Looking for a Princeton Dentist Who Accepts Your Insurance? · No Insurance or Not Covered. Aetna, Cigna, Delta Dental, MetLife, United HealthCare and more. Looking for dental insurance or dental insurance for seniors? Check the dental insurance. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. Cigna Dental Care (DHMO) Insurance Plan covers most preventive and diagnostic services at a competitive rate, or at no extra cost. I have the same question in mind, Aetna Platinum vs Cigna Which health insurance should I take, Aetna or Kaiser? 12 comments. r. 4. There is no Cigna dental network. All dental claims are administered subject to dental plan provisions, the annual dental deductible and the annual dental. Dental Indemnity is a type of dental insurance that gives you a lot of freedom. It's often referred to as a “traditional” dental plan or a “fee-for-service. Aetna Leap Dental PPO. AL IVL CB-HDentalPol Dental. 12/ & SOB AL IVL CB Cigna Individual Dental PPO. HC-NOT11 et. al./HC-CER Dental. 01/ CIGNA. Benefits included in every dental plan. Plan features for the way you live. With Aetna Dental, you get: Affordable plans. Plan options start at $ Insurance Plans Accepted · Aetna, Blue Cross, MetLife, Cigna, Many More · Looking for a Princeton Dentist Who Accepts Your Insurance? · No Insurance or Not Covered. Aetna, Cigna, Delta Dental, MetLife, United HealthCare and more. Looking for dental insurance or dental insurance for seniors? Check the dental insurance. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. Cigna Dental Care (DHMO) Insurance Plan covers most preventive and diagnostic services at a competitive rate, or at no extra cost. I have the same question in mind, Aetna Platinum vs Cigna Which health insurance should I take, Aetna or Kaiser? 12 comments. r. 4. There is no Cigna dental network. All dental claims are administered subject to dental plan provisions, the annual dental deductible and the annual dental.

Both dental PPO options allow you to take advantage of network discounts and get more benefit for theannual maximum by using a Cigna network dentist. You are. At the end of the year, the dental savings plan (or program) expires. Need dental coverage? Cigna Healthcare offers a variety of. or partially cover a multitude of dental services in exchange for a monthly premium. Like with most dental insurance providers, plans with Aetna are more. Choose from our plans that include basic dental coverage for general dental care — or explore coverage that includes major dental care, such as dental implants. Coverage Differences Between Aetna and Cigna International Health Services Benefits provided under Cigna are almost identical to those provided under Aetna. Dental Insurance companies and Discount Plans we accept: ACCESS (Cigna, Aetna, Guardian); ACS BENEFIT SERVICES; AETNA HMO/PPO; ADVANTICA PPO (DENTEMAX); AIG. You can obtain services via the Cigna network if you or Refer to Medical Insurance Administrators, Switching between Cigna and Aetna - Change Insurance. Cigna · About 16 million global customers and $41 billion in revenue rank Cigna number four for the largest health insurance companies in the United States. Dental Plans for Employees · CareFirst Dental Preferred Provider Organization (PPO) · Aetna Dental Maintenance Organization (DMO) · Kaiser Permanente Dental. We are in network with all major PPO plans and insurances including Delta Dental, Cigna, Aetna, Metlife and Guardian. Find out your cost before your. Vital Savings by Aetna is not insurance. There are no copays or deductibles, no paperwork or hassles. Once you enroll, you simply pay the discounted fee. No, Cigna Dental benefits do not roll-over if not used. The maximum resets each year on the 1st of July. Why doesn't the dental insurance cover all forms of. DMO® vs. PPO. Dental benefits and dental insurance plans are offered and/or undewritten by Aetna Health Inc., Aetna Dental. Inc., Aetna Dental of. However, if you'd like support in being proactive regarding your dental health, you'll want to choose Cigna for its Cigna Dental Health Connect™ program. It's. Cigna Dental is the best dental insurance for orthodontics. Most dental insurance plans only cover orthodontics for children up to age 18 or 19, but. The Cigna Dental Care (DHMO¹) plan includes coverage for many procedures that may not be available on other dental plans. There are no deductibles to pay before. FCPS offers you a choice of two dental plans: Aetna Dental Preferred Provider Organization (DPPO) or Aetna Dental Network Only (DNO). FAQ's about the Cigna. You can obtain services via the Cigna network if you or Refer to Medical Insurance Administrators, Switching between Cigna and Aetna - Change Insurance. Note: Dental premiums must be paid directly to AFSPA on a quarterly or annual basis. Cigna International Dental. Exclusive dental coverage for those living. To learn more about your Cigna Dental PPO plan, please watch this video. See any dentists you like. After you've met the individual or family deductible.

Reviews On Acorns

Acorns helps you invest and save for your future. With nearly $4,,, in Round-Ups® invested and counting, we are an ultimate investing. For a larger representative sample, refer to reviews of Acorns available online and on public review forums such as the Apple App Store and Google Play Store. Acorns is a unique robo-advisor that helps its users save money. But, with high fees, expense ratios, and little help with taxes, is the service truly worth. If you're looking for a managed portfolio that's invested in sustainable investments, then Acorns is your pick over Stash. Cash management accounts: Acorns vs. How many stars would you give Acorns? Join the people who've already contributed. Your experience matters. | Read Reviews out of Acorns IRA Review. Acorns is a legit company and its Later IRAs are a good investment option. In our Acorns review, we learned how it can help meet your. Setting up the insurance through acorns was hassle free and doesn't care about my health. In the least, my loved ones can use it to dispose of. What I liked about it: Ease of use with no minimum investment. Acorns makes investing a reality for anybody, regardless of income level or knowledge of the. games-tv.site · Write a review. Company activitySee all. Claimed profile. Replied to 74% of negative reviews. Replies to negative reviews in > 1 month. Acorns helps you invest and save for your future. With nearly $4,,, in Round-Ups® invested and counting, we are an ultimate investing. For a larger representative sample, refer to reviews of Acorns available online and on public review forums such as the Apple App Store and Google Play Store. Acorns is a unique robo-advisor that helps its users save money. But, with high fees, expense ratios, and little help with taxes, is the service truly worth. If you're looking for a managed portfolio that's invested in sustainable investments, then Acorns is your pick over Stash. Cash management accounts: Acorns vs. How many stars would you give Acorns? Join the people who've already contributed. Your experience matters. | Read Reviews out of Acorns IRA Review. Acorns is a legit company and its Later IRAs are a good investment option. In our Acorns review, we learned how it can help meet your. Setting up the insurance through acorns was hassle free and doesn't care about my health. In the least, my loved ones can use it to dispose of. What I liked about it: Ease of use with no minimum investment. Acorns makes investing a reality for anybody, regardless of income level or knowledge of the. games-tv.site · Write a review. Company activitySee all. Claimed profile. Replied to 74% of negative reviews. Replies to negative reviews in > 1 month.

We did the math, and if you invest on average $50 a month through your round-up investments with Acorns, using a 7% market return, then you will have over. Acorns Checking is STRONGLY RECOMMENDED based on 33 reviews. Find out why before you make a decision. How Acorns Banking Works · You must have an Acorns account to get banking services · Access to a checking account, emergency savings account, and debit card. Launched in , Acorns is a relatively young company and isn't rated by Moody's, S&P, or A.M. Best. However, the Better Business Bureau gives the company an. Acorns is just a robo-advisor. You can't buy whatever stocks and ETFs you want, as in a standard brokerage account. The platform also has a flat fee structure. This organization is not BBB accredited. Financial Services in Irvine, CA. See BBB rating, reviews, complaints, & more. one good thing about Acorns is that if you have the. roundup turned on or any form of automatic investing. then you don't even have to think about. The best part of Acorns is that you won't even notice the money missing out of your bank account. It just rounds your purchases up to the next dollar and it. With no minimum to open an account and only $5 required to start investing, the Acorns app ranks as one of the best robo-advisors that's safe to use for new. Acorns was rated out of 5 based on 21 reviews from actual users. Find helpful reviews and comments, and compare the pros and cons of Acorns. Bottom line. For those who want to invest their money but don't know where to start, Acorns is an approachable platform for beginners. It has a simple interface. Acorns is worth it if you need a helping hand with investing and want to build good habits. It's one of the best microinvesting apps out there, and it has. If you're looking for a managed portfolio that's invested in sustainable investments, then Acorns is your pick over Stash. Cash management accounts: Acorns vs. Acorns is a good choice for those looking to invest money without prior knowledge. The user-friendly platform offers a micro-investment feature that. “Acorns helps you save and grow your $ by automatically investing spare changeso you have to do very little to save and invest without really thinking about. Acorns is a well rounded company, well trusted, easy to use and understand. But still invest in your future, they even have a debit account that is a low cost. Reviewers have mixed opinions on Acorns: Save & Invest. While some praise its ease of use and ability to help save and invest effortlessly, others criticize the. Overall: Great experience and can't imagine not using Acorns. Pros: Love the ease and it's so great that it automatically puts money in your account by rounding. How Acorns Banking Works · You must have an Acorns account to get banking services · Access to a checking account, emergency savings account, and debit card. The lack of resolution and poor communication from Acorns has left me feeling frustrated and disappointed with their service. As a result, I'm left with a sense.

Robotics Software Engineer Udacity

The Udacity Robotics Software Engineer Nanodegree is an immersive course that provides users with hands-on experience. It'll help you dive into core robotics. Mike is the Service Lead and Community Owner for Udacity's Robotics Nanodegree Program. Mike's robotics experience includes working as a software engineer on. This program is a collection of courses and practical projects to programming robots using the ROS framework and C++ to build and apply algorithms for. Robotics Software Engineer Roadmap. Robotix Fast Track to Robotics Software Engineering | Udacity's Self-Driving Car Nano-Degree Review. Udacity Robotics Nanodegree. games-tv.site [공식] Udacity Robotics Nanodegree. 3D Perception: Project. The NEW Robotics Software Engineer Nanodegree Program is officially open! Explore the skills you'll learn, the tools you'll use. This program was built in collaboration with robotics engineers to ensure you learn the skills necessary for success in the field. Fuse computer vision, machine learning, mechanics, and hardware systems to build bots of the future! This Robotics Software Engineer program at Udacity. It looks pretty comprehensive - goes into ROS, kinematics, Computer Vision, and Deep Learning. The biggest advantage of this course is the practical guided. The Udacity Robotics Software Engineer Nanodegree is an immersive course that provides users with hands-on experience. It'll help you dive into core robotics. Mike is the Service Lead and Community Owner for Udacity's Robotics Nanodegree Program. Mike's robotics experience includes working as a software engineer on. This program is a collection of courses and practical projects to programming robots using the ROS framework and C++ to build and apply algorithms for. Robotics Software Engineer Roadmap. Robotix Fast Track to Robotics Software Engineering | Udacity's Self-Driving Car Nano-Degree Review. Udacity Robotics Nanodegree. games-tv.site [공식] Udacity Robotics Nanodegree. 3D Perception: Project. The NEW Robotics Software Engineer Nanodegree Program is officially open! Explore the skills you'll learn, the tools you'll use. This program was built in collaboration with robotics engineers to ensure you learn the skills necessary for success in the field. Fuse computer vision, machine learning, mechanics, and hardware systems to build bots of the future! This Robotics Software Engineer program at Udacity. It looks pretty comprehensive - goes into ROS, kinematics, Computer Vision, and Deep Learning. The biggest advantage of this course is the practical guided.

Troubleshooting issues in the Robotics Software Engineer Nanodegree. Part Term 1: ROS Essentials, Perception, and Control · Lesson Udacity Explores - Human Robot Interaction & Robot Ethics. Learn about some of the. All the courses available at Udacity are free of cost. There is a paid version where you get the same free courses but also extra projects to. Udacity Robotic Software Engineer Nanodegree program. It is used along games-tv.site + Share. Fuse computer vision, machine learning, mechanics, and hardware systems to build advanced robots. Learn simulation, ROS, localization, mapping, SLAM. UDACITY · Embedded SystemsNetworking. program-type Certification Save Brochure. vendor. Become a Robotics Software Engineer · UDACITY · C. difficluty-. Robotics Software Engineer Nanodegree from the category Computer Science, IT at Edukatico. Udacity. Course language: English. Fees: Yes (see course website). Build hands-on projects to acquire core robotics software engineering skills: ROS, Gazebo, Localization, Mapping, SLAM, Navigation, and Path Planning. Welcome to Udacity's Robotics Software Engineer Nanodegree program resource! As a community member you will have access to a variety of resources. Please take. For help from Udacity Mentors and your peers visit the Udacity Classroom. Nanodegree Program Info. Begin your exploration into the world of robotics software. Take Udacity's Artificial Intelligence of Robotics course and learn how to program all the major systems of a robotic car. Learn online with Udacity. Jul Upvote ·. Profile photo for Mayur Pandya · Mayur Pandya. BE in Mechanical Engineering & Robotics, Savitribai Phule Pune. Robotics Software Engineer Obtain an architectural overview of the Robot Operating System Framework and setup your own ROS environment in the Udacity. David Silver leads the School of Autonomous Systems at Udacity. Before Udacity, David was a research engineer on the autonomous vehicle team at Ford. He has. The Robotics Software Engineer Nanodegree program revolves around 5 uniquely curated, industrial robotics projects that test the burning consulting assignments. SpringPeople is an Authorized Training Partner of Udacity. Get Udacity Robotics Software Engineer Training & Certification from Experts. Ramy Ali. Product Designer | Experienced UX/UI Designer @Flick Global |Software Engineer | Interaction Designer | Help Your Business to Get. Begin your exploration into the world of robotics software engineering with a practical, system-focused approach to programming robots using the ROS. The Robotics Software Engineer Nanodegree program provides an introduction to software and artificial intelligence as applied to robotics. The areas we focus on. As announced at Udacity's Intersect Conference, applications are now open for our groundbreaking new Robotics Software Engineer.

Save Money Challenges

Curious if anybody else who frequents the sub has any similar kinda games/gimmicks for saving or minding their spending? The right money challenge can unleash your competitive spirit, increase motivation, and amplify your savings. Ready to try? Here are five challenges to help. Money Saving Challenges That Are Fun · 1. The Temperature Match Challenge · 2. The No-spend Challenge · 3. The Keep-the-Change Challenge · 4. The Week Money. Savings challenges · increment 52 week savings challenge · 52 Week $ Saving Challenge · bill saving challenge. Savings challenges are a fun and engaging tool for taking control of your finances! 【Money Saving Challenge Book】- Stay on top of your progress with the handy. 1. Sign up · 2. Set a goal · 3. Save for 30 days · 4. Celebrate your savings! Meet the week money challenge—a simple plan that could help you turn relatively small weekly savings throughout the year into a tidy sum. Aug 21, - Explore porsha bryant's board "Savings challenge" on Pinterest. See more ideas about savings challenge, money saving strategies, saving money. The Day Penny Challenge: With this challenge, people make a daily savings deposit and increase their deposit by a penny a day. At the end of a year, they. Curious if anybody else who frequents the sub has any similar kinda games/gimmicks for saving or minding their spending? The right money challenge can unleash your competitive spirit, increase motivation, and amplify your savings. Ready to try? Here are five challenges to help. Money Saving Challenges That Are Fun · 1. The Temperature Match Challenge · 2. The No-spend Challenge · 3. The Keep-the-Change Challenge · 4. The Week Money. Savings challenges · increment 52 week savings challenge · 52 Week $ Saving Challenge · bill saving challenge. Savings challenges are a fun and engaging tool for taking control of your finances! 【Money Saving Challenge Book】- Stay on top of your progress with the handy. 1. Sign up · 2. Set a goal · 3. Save for 30 days · 4. Celebrate your savings! Meet the week money challenge—a simple plan that could help you turn relatively small weekly savings throughout the year into a tidy sum. Aug 21, - Explore porsha bryant's board "Savings challenge" on Pinterest. See more ideas about savings challenge, money saving strategies, saving money. The Day Penny Challenge: With this challenge, people make a daily savings deposit and increase their deposit by a penny a day. At the end of a year, they.

A savings challenge is a great way to work on your budgeting skills while saving money along the way. This week savings challenge is easy, fun, and. 12 MONTH Savings Challenge ENVELOPES A6 Savings Challenge Tracker Envelope 5K 2K for A6 Binder budgeting Cash Envelope for A6 Binder. Part of the challenge when it comes to saving money is learning how to make it a regular habit. With the week money challenge, your child starts by saving $. 2. The 1% challenge · Calculate what 1% of your monthly wage amounts to · Set up a savings account · Arrange a standing order to put money in. · Come back to the. 8 money-saving challenges to supercharge your savings · 1. week money saving challenge · 2. Biweekly money-saving challenge · 3. Reverse week saving. The book shows how to save money with simple lifestyle changes and creative ideas. The book is excellent for those who struggle with discipline regarding. Savings challenges · increment 52 week savings challenge · 52 Week $ Saving Challenge · bill saving challenge. We've has compiled a list of popular new year money saving challenges, to help inspire and support your saving goals. 1. Spending too much on housing · 2. No defined budget · 3. The “I'll save when I make more money” mindset · 4. Lack of a measurable savings goal · 5. Student loan. Money-saving challenges, which can be found on Pinterest and personal finance blogs, inspire spenders to start saving by finding innovative ways to cut costs. Sometimes you just need a challenge to get things done. Here are ten financial challenges to help you cut back on your spending and save more money. The Money Challenge: 30 Days of Discovering God's Design For You and Your Money. Low Income Savings Challenges: Ultimate Book of Savings Challenges | Easy And Fun Way To Save Money | 50, , , , Is your New Year's resolution going to be to save more money? Breaking bad habits and increasing your financial security is an admirable resolution – but it. The following savings challenges offer creative ways to set money aside. Try one — or try them all. No matter which challenge you choose, you'll save money and. While we all recognize the importance of saving money, it can be hard to fit it in when your budget is already stretched thin. Consider trying the Week. WEEK. SAVE. BALANCE DONE. 1. $ $ 2. $ $ 3. $ $ 4. $ $ 5. $ $ 6. $ $ 7. $ $ The $2, Savings Challenge. This challenge features two weeks “off” (at the saver's discretion) and a reduced final deposit. Week # Deposit Total. We've collected eight of our favourite challenges that could help you get started with saving. You can try saving daily, weekly or monthly. There are many versions of this challenge. You can start with a small savings amount, like $3 or $4. If you choose the first amount, put $3 away in savings the.

Lowest Payment Plan For Student Loans

An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0. Use the Education Department's Loan Simulator to choose the right plan. We may have options to help temporarily manage your student loan payments. This page provides an overview of those payment assistance options. Monthly Payments for Federal Education Loans Except Consolidation Loans · start out low and increase every two years, · are made for up to 10 years for all loan. The Saving on a Valuable Education (SAVE) plan is a type of income-driven repayment (IDR) that could lower some borrowers' student loan payments to $0. Overview: Online lender Earnest funds private student loans to undergraduate and graduate students and offers unique repayment options. Earnest's grace period. total federal loan debt,. AGI, and family size. Based on your AGI, family smallest payment. Longer loan term, which makes payments lower. A reduced. There is a $50 minimum monthly payment. Learn more: Department of Education Standard Repayment Plan. Extended Repayment. This plan is like standard repayment. Borrowers with more than $30, in federal student loans through a single loan program, can lower their monthly payments by extending their payments for up to. If you want to pay off your student loans quickly, consider a Standard plan. In the Standard plan, your payments are the same amount every month and you will. An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0. Use the Education Department's Loan Simulator to choose the right plan. We may have options to help temporarily manage your student loan payments. This page provides an overview of those payment assistance options. Monthly Payments for Federal Education Loans Except Consolidation Loans · start out low and increase every two years, · are made for up to 10 years for all loan. The Saving on a Valuable Education (SAVE) plan is a type of income-driven repayment (IDR) that could lower some borrowers' student loan payments to $0. Overview: Online lender Earnest funds private student loans to undergraduate and graduate students and offers unique repayment options. Earnest's grace period. total federal loan debt,. AGI, and family size. Based on your AGI, family smallest payment. Longer loan term, which makes payments lower. A reduced. There is a $50 minimum monthly payment. Learn more: Department of Education Standard Repayment Plan. Extended Repayment. This plan is like standard repayment. Borrowers with more than $30, in federal student loans through a single loan program, can lower their monthly payments by extending their payments for up to. If you want to pay off your student loans quickly, consider a Standard plan. In the Standard plan, your payments are the same amount every month and you will.

At its core, each IDR plan sets repayment at what is hopefully an affordable level, allowing your monthly payment to potentially drop as low as $0 if you have. Here are eight different strategies to help you lower your student loan payments so you can have more flexibility and control over your finances. Your monthly payments will be at least $50, and you'll have up to 10 years to repay your loans. Your monthly payment under the standard plan may be higher than. Standard Repayment Plan. The basic repayment plan for loans from the William D. Ford Federal Direct Loan (Direct Loan) Program and Federal Family Education Loan. 1. Standard Repayment Plan · Who's eligible: All borrowers · How it works: Payments are fixed and loans are paid off over a year period. · Who it benefits. Standard Repayment · This plan is the most financially effective way to repay your student loan while minimizing interest costs. · Payments are due monthly . There is no minimum monthly payment. Unlike income-contingent repayment, which is available only in the Direct Loan program, income-based repayment is available. Reduced Payment Plan allows you to make six months of interest-only payments. Defer your student loans when you go back to school at least half-time or are. For the academic year , the interest rate for PLUS loans is % and the origination fee is about %. They also require a credit check, so students. Under the standard repayment plan, you will pay a fixed amount of at least $50 each month for up to 10 years. Basic Repayment Plans · Standard Repayment: Repaying the loan in equal monthly payments of at least $50 for the life of the loan up to months (10 years). payment amounts for all federal student loan repayment plans. This comparison is important because the Extended Plan may not provide you with the lowest. Number of Monthly Payments under the Standard and. Graduated Repayment Plans for Consolidation Loans based on the Total Student Loan Indebtedness Amounts. If. Federal student loans: Federal loans offer a variety of income-driven repayment (IDR) plans that base your payment on your income and household size. You could. year term, depending on the amount you owe · $50 minimum monthly payment · Payment can be graduated or fixed · Must have $30, in federal student loan debt. For the Old IBR, New IBR, and PAYE payment plans there is an interest subsidy for subsidized loans for the first 3 years on the plan of % of the difference. Standard repayment plans last up to 10 years, or up to 30 years for Consolidation Loans. They have fixed monthly payment amounts, with a minimum monthly payment. Federal Loans · You can make smaller monthly installment payments at the beginning of the repayment period. · Your monthly installment amount varies during. For example, if you start out making $25, and have the average student loan debt for the class of — $38, – you would be making monthly payments of. Borrowers in the IBR can have a payment as low as $/mo. Pay As You Earn (PAYE) – This plan usually has the lowest monthly payment and is also based on.